does doordash do quarterly taxes

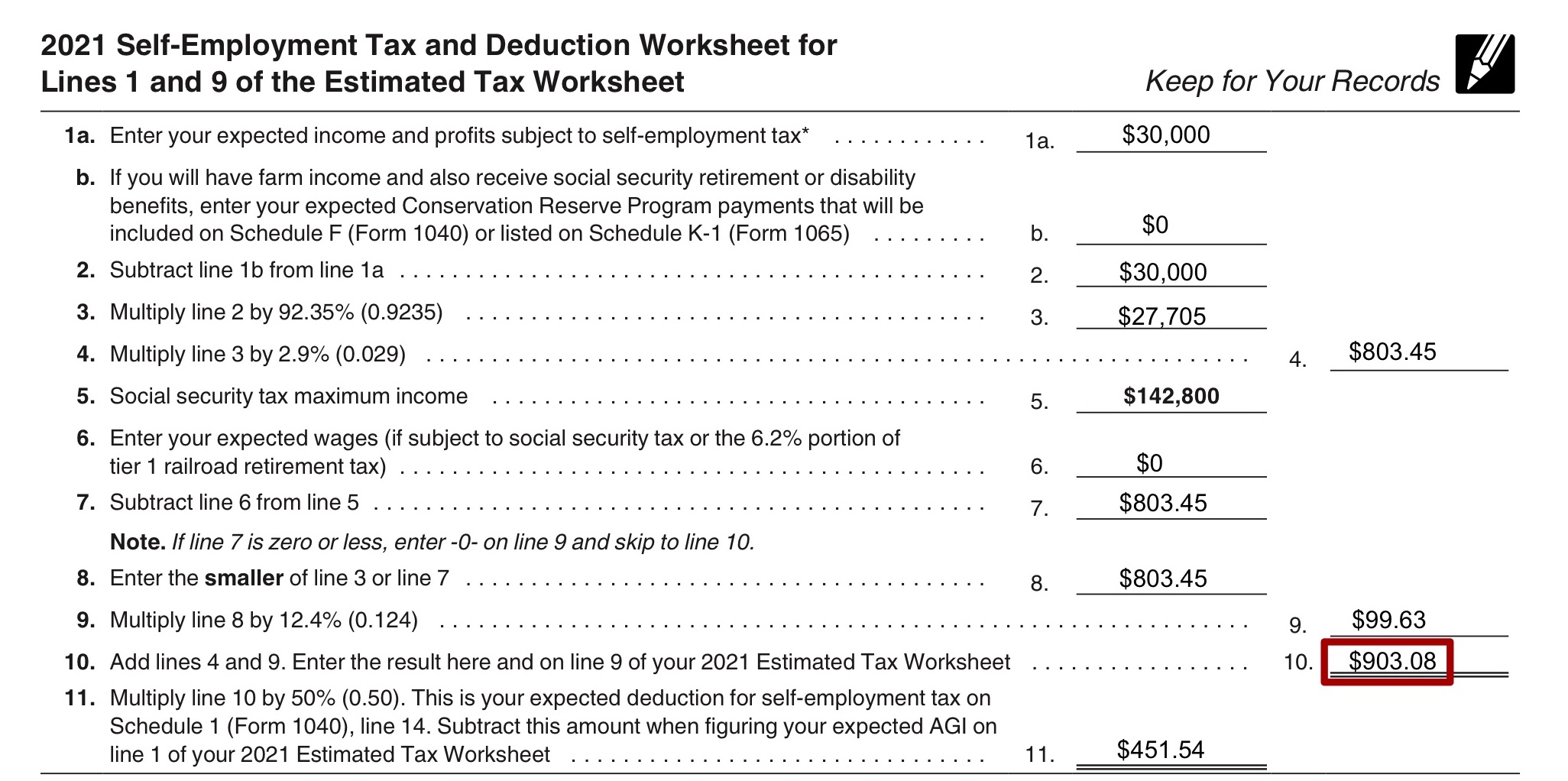

To pay the estimated taxes for Q1 you must total your DoorDash income for the quarter and multiply your income by 153. Do you owe quarterly taxes.

Complete Guide To 1099 Doordash Taxes In Plain English 2022

If you earned more than 600 while working for DoorDash you are required to pay taxes.

. Since youre an independent contractor you might be responsible for estimated quarterly taxesespecially if DoorDash is your sole source of income. Do you file yearly or quarterly taxes. Expenses such as cell phone cell phone bill clothes for work etc you do not pay much in taxes.

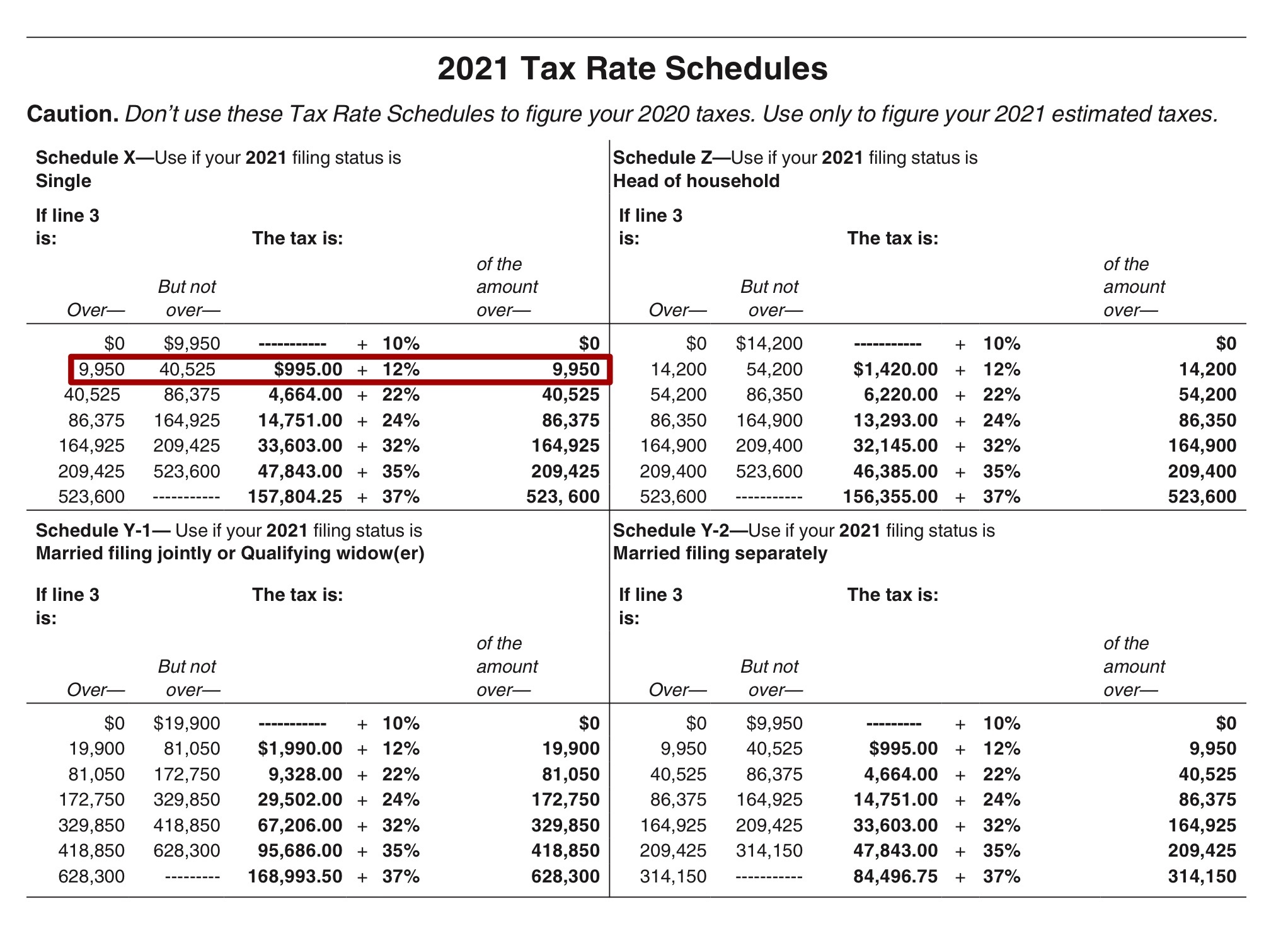

The rate from January 1 to June 30 2022 is 585 cents per mile. With the standard deduction option. Your FICA taxes cover Social Security and Medicare taxes 62 for Social Security and 145 for Medicare.

DoorDash drivers are self-employed rather than employees. If you will owe money on taxes this year you really want to think about getting a payment sent in by tomorrow if you havent already done so. Every mile driven on the job saves you about eight cents in taxes.

Working for Door Dash you may claim 55 cents a mile deduction on your Door Dash income for tax purposes. Dashers in the US Dashers in Canada Dashers in. DoorDash doesnt withhold taxes so youll.

Yes - Just like everyone else youll need to pay taxes. Federal income and self-employment taxes are annual. Since you are filing as self-employed you are liable for a 153 rate.

Do you owe quarterly taxes. If you track your miles. This should be an easy fraction to compute and cover you unless you.

How much do you pay in taxes if you do DoorDash. Do you owe quarterly taxes. How Do Taxes Work with DoorDash.

This will substantially reduce your taxable income. The subtotal is not based on the date you completed the dash. Keep in mind.

The self-employment tax is your Medicare and Social Security tax which totals 1530. Do you have to pay quarterly taxes for DoorDash. This means if you made 5000 during 2021 for DoorDash your tax.

Since youre an independent contractor you might be responsible for estimated quarterly. We calculate the subtotal of your earnings based on the date the earnings were deposited. It doesnt apply only to.

The Doordash mileage deduction 2022 rate is 625 cents per mile starting from July 1. You pay 153 for 2017 SE tax on 9235 of. Dashers will not have their income withheld by the.

DoorDash does not automatically withhold taxes. I keep my daily mileage in a. If you made 5000 in Q1 you should send in a Q1.

Make quarterly payments of 15 of your net income. There isnt a quarterly tax for 1099 Doordash couriers. Since youre an independent contractor you might be responsible for estimated quarterly taxes.

FICA stands for Federal Income Insurance Contributions Act. That makes it important to understand the DoorDash tax rules. Self Employment tax Scheduled SE is generated if a person has 400 or more of net profit from self-employment on Schedule C.

Do I have to pay DoorDash taxes quarterly. We file those on or before April 15 or later if the government.

Quarterly Tax Questions R Doordash Drivers

How To Pay Quarterly Income Tax 14 Steps With Pictures

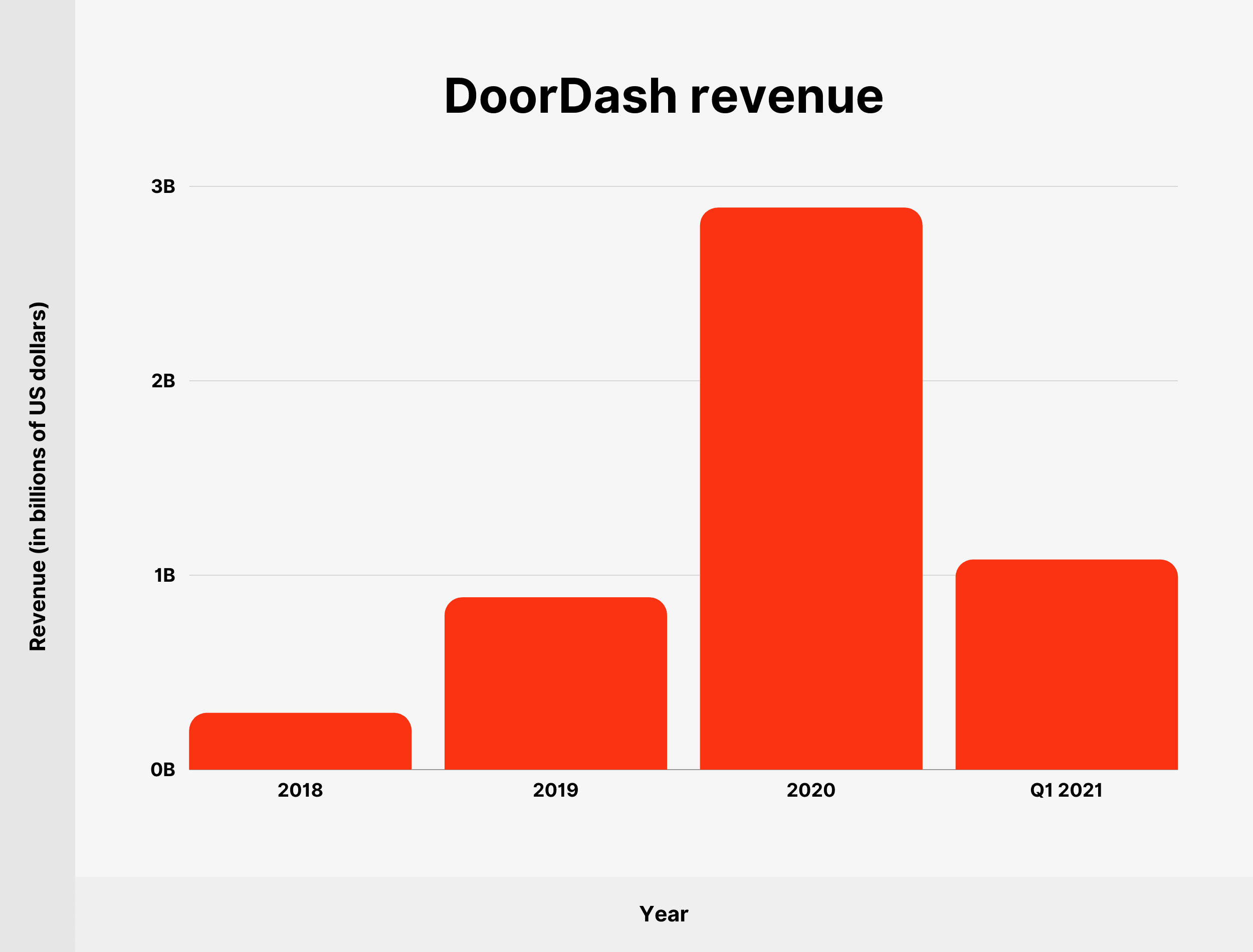

Good News For Doordash Revenue Surges Higher Despite Reopening The Motley Fool

My Door Dash Spreadsheet Finance Throttle

How Do I File Estimated Quarterly Taxes Stride Health

Do Doordash Contractors Pay Quarterly Taxes Entrecourier

How To Make Quarterly Estimated Tax Payments

My Door Dash Spreadsheet Finance Throttle

How Many People Use Doordash In 2022 New Data

Self Employed Tax Walkthrough 2021 Doordash Grubhub Uber Etc Youtube

How Do Food Delivery Couriers Pay Taxes Get It Back

Pro Door Dasher Shares Tips To Maximize Your Earnings

Complete Guide To 1099 Doordash Taxes In Plain English 2022

Do Doordash Contractors Pay Quarterly Taxes Entrecourier

Doordash Taxes Does Doordash Take Out Taxes How They Work

Doordash Taxes Does Doordash Take Out Taxes How They Work

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

When You Deliver With Ubereats Or Doordash How Do You Track Your Mileage For Taxes Do You Paper And Pen It Or Use An App What App And Do You Pay Fees